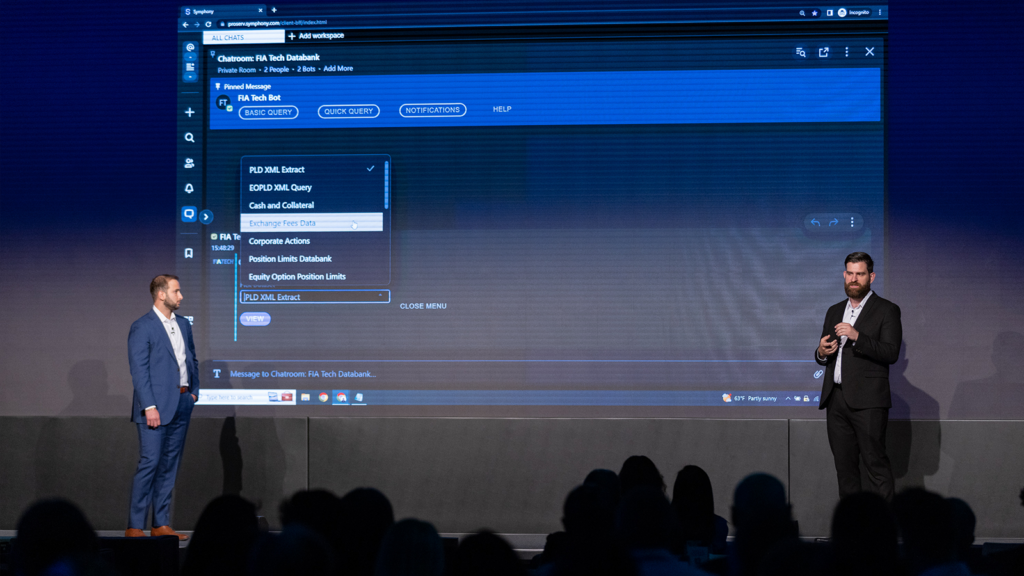

Cloud9 is now part of Symphony

Cloud9 is the leading cloud-based, compliance-enabling voice platform purpose-built for high-touch communications. For information and resources about our suite of products, please follow the links below.

Learn about our suite of voice products

Access the Cloud9 Admin portal

Obtain resources and support for users

Reach out to the Cloud9 team