by Cloud9 | Jan 17, 2017 | News, Press Coverage, Thought Leadership

Success of a company is often a double-edged sword for technology teams. Enthusiastic customers, positive sales numbers and increased opportunity generally mean only one thing for a CTO—the need to scale.

For start-ups, determining how and when to scale can be a challenge. Just when you hire your first set of developers and build the product, you’re faced with the need to grow your team and ensure that technology can accommodate an expanding number of users.

Resource management is also key—and technology and process, in addition to people, can help you to scale wisely without having to rebuild your product. After managing the challenge of scaling at a number of companies, I’ve narrowed it down to three elements of scaling to keep in mind when it comes to people.

Flat structures vs. well-defined units

As you grow, your goal as a leader should be to create just enough process and structure that enables people to complete projects independently—but not so much that you lose oversight. Here at Cloud9, we’ve gone from a flat structure on the development team to small stable teams, each with a defined leader.

As the team grew, we realized a flat structure became challenging to manage. It was similar to going to a networking event and trying to talk with everyone in the room at the same time—it became too overwhelming to focus on the tasks at hand. Smaller teams helped me manage better and helped everyone focus and communicate better.

Create alignment

When your start-up enters a growth stage, team alignment is also important. Everyone needs to be on the same page about the mission, even if they don’t all agree on how to get there. Getting others to buy into your mindset is so important. I encourage engineers to make suggestions for changes that they could brag about to their friends and family.

I cannot overemphasize the importance of encouraging innovation from within. It empowers teams by reinforcing the belief that everyone should be moving fast and making an impact. That impact is what takes a team from zero to 60 when it comes to growth.

Create accountability

Part of scaling is also finding out what behaviors can be defined as valuable to the organization and encouraging those behaviors to spread throughout. The best way to do this is to make people feel accountable for the success of your start-up’s growth. When teams have structure and a mission, and individuals are properly recognized for accomplishments, you can create a sense of ownership that reinforces itself and can spread across employees.

Adam Pisoni, founder of Yammer, exemplified a lot of these concepts when it came to preparing his organization and employees for scaling. While growing his company, one of his engineers brought up the idea of Conway’s Law, which says: Companies create products and services that are a reflection of themselves—the way they’re organized, communicate and work. Establishing roles, defining a clear mission and creating accountability can help your team be productive while maintaining ownership and focus on building great products.

Putting the pieces together—poised for growth

With the right amount of structure, alignment and accountability, your organization will have the right foundation to not only scale, but to go faster and maintain agility as your company grows. Even if you’re not sure where to start, there are a lot of great takeaways that you can learn from companies that have scaled successfully, such as Google and Facebook, and you can incorporate them into your own team.

Original Article in Network World.

by c9tec | Dec 15, 2016 | News, Press Coverage, Thought Leadership

See article in No Jitter.

As users of WebRTC, we’re in great company, with tech-giants such as Facebook, Slack, Snapchat, and WhatsApp utilizing it in their services. In fact, Blacc Spot Media recently reported that over $2.7 Billion in funding went to WebRTC companies in 2016.

Use of WebRTC, a versatile technology, is growing rapidly. WebRTC is being applied in many different ways, for many different audiences. As technologists, we always want more, so recently I sat down with my chief architect, Andy Pappas, and we came up with our WebRTC wish lists for the holidays.

Leo’s Wishlist:

An Enterprise-Grade Managed STUN/TURN Server

With traditional SIP, there are Session Border Controllers (SBC’s) that exert control over signaling. However, in the WebRTC world, since we don’t have standard signaling, we need to get as close as we can to establishing an SBC. The solution would be an enterprise STUN/TURN server. STUN, formally Session Traversal Utilities for NAT (network address translation), basically echoes a public IP address back to the endpoint. TURN, Traversal Using Relays around NAT, acts like a lightweight media relay when a peer-to-peer connection cannot be established.

Some solutions have a STUN/TURN server for the enterprise but come with too many built-in features and require you to lock onto specific app’s servers. A simple STUN/TURN server with the management features needed by enterprises doesn’t exist today.

Support For RETURN

Since enterprises will continue to use symmetric firewalls, a STUN/TURN server will still be needed in the cloud. For the above process to work, the WebRTC stack must support RETURN to help avoid call failure. Recursively Encapsulated TURN or RETURN allows the browser to encapsulate two TURN servers in one.

Andy’s Wishlist:

More Efficient Peer Connection

In peer to peer networking, it would be great to have a more efficient Interactive Connectivity Establishment (ICE) when multiple STUN/TURN servers are available. In this scenario, WebRTC can take a relatively long time and consume high CPU and memory when a user needs to connect to many peers in a mesh configuration.

A more efficient solution would be to cache or test a connection to a TURN server or list of TURN servers, have the call connect to those, and then later switch to a STUN server or continue with TURN. Right now we’ve customized how we connect to alleviate this delay and load, but there is a lot of room for improvement in this area.

Microphone and Audio Level Alerts and Limits

The detection of and alerts letting users know that they are too close to or have applied too much gain to their microphones would be helpful. If speech/noise statistics were collected over time, this could translate to an API that would signal users if they are operating the microphone incorrectly or were in an environment requiring a different gain level or microphone. Being able to add configurable microphone loss and boost within audio processing would be nice, as well.

An auto level or hard limit on incoming speech at the channel level would also help cases where multiple users are speaking at the same time, which is frequent in the financial services industry.

De-Reverberation Algorithm

Reverberation is a very common problem for a typical home or office user and can be a huge degradation to speech intelligibility on a communication platform. This is solvable with selection of appropriate microphone hardware, however a better, or complimentary, solution is to add a de-reverberation algorithm on the microphone. It might even be possible to characterize the environment by using the speaker-to-microphone acoustic path or model from the acoustic echo canceler.

What’s on your WebRTC wish list this holiday season?

by c9tec | Dec 8, 2016 | News, Press Coverage, Thought Leadership

There are many ways for for modern CTOs to ensure they’re forging the right path for their team and company. Start by asking the right questions.

Original Article in Network World.

I’ve built my career in a field where trader voice technology has only improved incrementally over the past 40 years. After decades of building legacy technology, my co-founders and I set out to disrupt the industry we had helped build.

Despite years of leading technology teams and large-scale product launches, I was presented with a unique opportunity to start from the ground up. I had to start from scratch with a new set of technology, build a team, create architecture that was future-proof, scalable, secure and compliant, and take on the task of educating our customers and my team about why WebRTC and the Amazon Cloud was the right technology for our stack. It was daunting task, but also a common set of circumstances for a modern startup CTO.

The Building Blocks

In the early days of Cloud9 Technologies, we knew what we wanted to build: a communication technology that eliminated the complexity and hassle of dealing with legacy systems. Our team drew its inspiration from modern communications solutions, that were hosted in the cloud, mobile-first and easy to use—such as WhatsApp.

The challenge was layering in capabilities that could support the deployment of solutions on trading floors and creating technology that could handle the communication complexities of that environment. In addition, the financial services industry is highly regulated, with unique security requirements, strict compliance mandates, and no room for error when it comes to communication. We had to ask ourselves three important questions:

1. What cloud provider do we choose? Will it evolve with us and allow us to scale efficiently?

2. Should we work with a technology stack we are familiar with or attempt something new?

3. How much of the technology will we have to build up versus leveraging an open source technology that we can build on top of?

The CTO as Evangelist

If you’re embarking on a journey to displace incumbent technology, you’ll quickly find yourself in the role of both CTO and evangelist. It is important in terms of driving new technology that both your customers and your developer team view you as a resource and a thought leader.

I’ve spent a lot of time listening and engaging with customers via support calls in the early days, as well as interacting through social media, speaking engagements and sales calls. Developing a sense of trust and understanding between you and your customer helps open them to the possibility of adopting your solution. Also, once you begin to see your product from the perspective of your customers, you’ll be better able to address their needs and bring value.

It’s also important to show off the accomplishments of your team and share how you’re adapting certain technologies to build your product. Early on, we participated in a thought leadership forum with Amazon, discussing why the cloud was ready to handle critical operations such as communication. We chose the technology we’re using for a reason, so it’s important to stand next to other thought leaders and validate your technology story.

We also empower our employees to do the same. It’s important to encourage them to complete new certifications, attend conferences and participate in local meetups. It serves as a great reminder that what they’re doing has impact and meaning on the world outside of the company.

The role of the modern CTO comes with more hats and responsibilities than ever before. But by asking the right questions and setting up the right building blocks for your company, you’ll provide a solid foundation on which to build a successful and scalable product. Use that foundation to empower and promote the accomplishments of your team. By establishing your team as a thought leader, you attract the trust of current and future customers who will support and advocate for your company.

Follow Leo’s Column on Network World.

by c9tec | Dec 6, 2016 | News, Press Coverage

By Amir Zmora

Original Article on The New Dial Tone

I had several questions lately from vertical service providers contemplating about the technology to use for their video service.

They were hesitant if building with WebRTC is the right way to go.

Then I came across this presentation by Leo Papadopoulos, CTO & Co-founder of Cloud9 Technologies and decided to tie these two things together.

Cloud9 has made their technology choice in the early days of WebRTC and took a slightly different approach to using it, an approach that served their mission critical needs. His presentation explains why this was one of the best choices they have made.

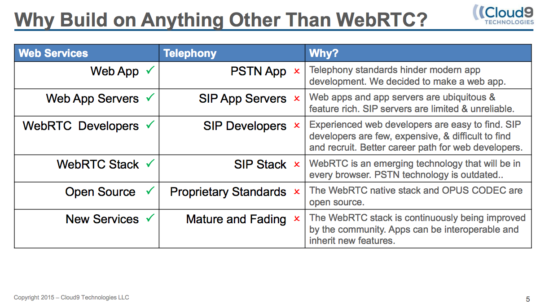

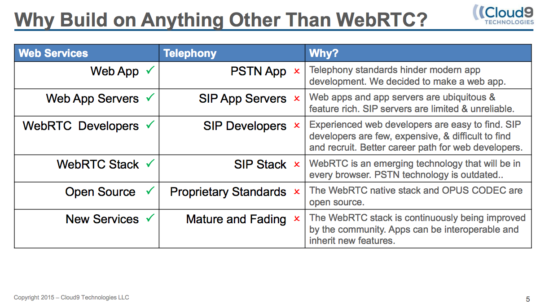

Let’s review these points one by one.

Web App vs. PSTN App

It is all about your viewpoint. WebRTC takes the Web view approach, it is built for the Web and for Web developers.

Think of the rate in which your telephony application is updated, be it a server or an IP Phone and what it takes to actually make that upgrade.

Now think of making changes to a Web app, it is like updating a Web page. You submit the change and it’s there. To all.

Web apps move in the speed of light compared to telephony applications. That’s one of the reasons why traditional UC companies have a hard time catching up with the new comers such as Slack, WhatsApp, Facebook Workplace…

Web App Servers vs. SIP App Servers

I don’t know about the reliability part in Leo’s explanation (any application can be unreliable) but I can relate to the opportunities in Web app servers. The speed of developing and changing them based on existing frameworks.

As an example, we have built the signaling server of SwitchRTC based on node.js. I compare this to what it took to build a SIP Server back in my VoIP SDK days at Radvision, the size of the team and the speed in which it was built and reached maturity.

WebRTC Developers vs. SIP Developers

I would term this as Web Developers vs. VoIP Developers but there is more granularity to it than just this comparison.

WebRTC was built for the Web and for Web developers. When looking at the browser side and Web applications, Web developers (different from VoIP developers) swim like fish in water in this field and it is by far easier to find a Web developer than it is to find a VoIP developer.

The things a VoIP developer needs to get into when building a VoIP application are by far more complex than what is required to tackle when building a Web application on top of WebRTC. In the case of VoIP applications, you would typically need engineers of different disciplines to cover it all.

Problems reside mainly on the server side and in the areas that touch the media.

Even if you are building a WebRTC based service, if the server side needs to handle media related stuff (meaning it is not just a point to point signaling server type of application), things get more complex. That’s why many use API platforms (that offer the server side + client SDK) or a 3rd party solution that will handle these complexities.

In SwitchRTC we’ve built our SFU media server model based on a modified version of WebRTC. This saved us a lot of time and effort and gives us interoperabity and feature advantages. It also makes our solution future proof as we “grow” with the new WebRTC releases.

Having said that, playing in the media field requires knowing about media, RTP and networking, something not so common among Web developers. To grasp what it takes to handle these stuff take a look at our hiring posting for a developer. Notice the skills we define as mandatory vs those that are an advantage.

All this is why vendors and service providers prefer to have these server components provided to them by 3rd party companies vs. building it all by themselves.

WebRTC Stack vs. SIP Stack

These 2 are very different in nature, so different that they sometimes complement each other.

A SIP stack is an implementation of the SIP protocol which is a signaling protocol, it has nothing to do with the media itself, it does use SDP for describing the media.

WebRTC on the other hand is all about the media, it is a media engine. Similar to SIP it uses SDP (that is until ORTC kicks in) but it has nothing to do with signaling or how that SDP is passed between the clients. That’s why some implementations (mainly those that bridge WebRTC and telecom) use SIP over WebSockets for their WebRTC signaling.

Another important point is that WebRTC (through the W3C) defines the APIs so applications running in the browser are compatible. SIP on the other hand doesn’t define the APIs.

Open Source vs. Proprietary Standards

Well, both SIP and WebRTC are standards. SIP is defined by the IETF and WebRTC is defined by both the IETF (all things that go over the wire such as media, security…) and W3C (API related stuff).

SIP on the other hand has many “private” or commercial implementations like the one offered by the BU I used to work for at Radvision which is now Spirent (one that I still believe is probably the best and most comprehensive SIP implementation out there). And there are of course open source options as well.

So I wouldn’t make the open source vs. proprietary comparison but rather say that the common implementation of WebRTC used by the industry is open source and developing a private implementation of WebRTC today would by a silly thing to do.

New Services vs. Mature and Fading

In this sense I would say that WebRTC is what powers most of the new services. This is correct for communications centric ones as well as other services that use communications as a feature in them.

Why this is important

Anyone building a new service that requires communications capabilities in it would need a good and special reason to decide to build his service on anything other than WebRTC.

Those who are worried about the stability/maturity or anything else around WebRTC can learn from this case study of Cloud9, a mission critical financial application and many others who are happy they made the right choice. Or they can see what SnapChat, Facebook Messenger, Slack and others are doing, they all based their communications service on WebRTC.

Read Original Article on the New Dial Tone.

by c9tec | Nov 14, 2016 | News, Press Coverage

Read the Original Article on Financial Revolutionist

Just about every entrepreneur would love to disrupt his or her chosen market, run an industry leading organization, enjoy multiple exits and come out of semi-retirement to start a fast growing company on the cutting edge. In fact, most would be happy to cross off just two or three items from that bucket list. But for Gerald “Jerry” Starr, all of those achievements — and several more — have been accomplished. That’s not an accident. His considerable success stems from his knowledge, creativity, work ethic and loyalty. Recently, The FR’s Gregg Schoenberg had the opportunity to sit down with Starr to learn more about his newest financial telecommunications company, Cloud9 Technologies. The company is reimagining how traders communicate with each other, but when you sit down with Starr, you quickly realize that his wisdom is applicable to entrepreneurs in virtually any sector.

FR: Welcome Jerry. Can you provide some perspective of your career prior to Cloud9?

JS: Thank you, Gregg. I have spent my entire career in the financial community, particularly in the trading communications area. In 1980, I started my first company, Tec Turrets, which was acquired by Tie Communications in 1984. My next opportunity was with Bridge Electronics, which created a so-called shout system that banks used to trade currencies. That company was sold to IPC in 1993, which led to my becoming the CEO.

At that point, there was a new economy and old economy. I was an old economy guy who tried to make money every day. I never understood how the new economy worked and decided to take a break until 2002. Then, with a few folks who are at Cloud9 today, we started Lexar. The company did voice-over IP that serviced financial firms in hard to get places in the financial community. We had success there and ultimately sold it in 2006 to Westcom Corporation.

From there, I went into semi-retirement until 2014, when my co-founder, Steve Kammerer, came up with the idea of making private lines used by traders more programmable and easier to use.

FR: That’s truly impressive. As it relates to your latest venture, let’s start with a basic question. Does voice trading have a bright future in a world of hyperconnectivity and machine to machine trading?

JS: Yes, there is still going to be growing demand for voice solutions across all asset classes. I know there are folks out there who say, ‘Hey, voice is going to go away.’ But what we have seen repeatedly is that voice is here to stay.

FR: But, of course, not every asset class is created equal?

JS: Right. Fixed income, currency and commodities are about 80 percent voice and then it kind of goes down from there. But even if you look at certain parts of equities, which may be just 30 percent voice, there is still going to be demand for voice.

FR: What technology serves as the basis for your solution?

JS: Leo Papadopoulos, one of the founders, picked out WebRTC, which is a Google open source technology that is great for real-time voice, messaging and video. It was a new technology at the time and there wasn’t a lot of adoption. Still, we were confident that the technology would become accepted over time.

FR: And how does WebRTC disrupt the turret system that remains a fixture on many trading desks?

JS: In a traditional trading company, a company has a turret system that sits on a trader’s desk and costs around $10,000 per unit. That turret connects to private lines over a point to point system. That means that when a trader at one institution wants to call someone at another institution, they push a button and they know that the person at the other end is going to be there. It doesn’t go through the dial tone network, but if you’re connecting two people over long distance, it’s very expensive and very inefficient. We came up with a cloud-based solution that addresses those problems by eliminating hardware and makes connecting to other traders as easy as connecting to someone via social media. WebRTC also enables users to communicate via the internet, so it eliminates private lines.

FR: When you looked to build this cloud-based alternative, how confident were you that anyone would adopt it?

JS: When we started, we weren’t sure the Tier One banks would be interested. And if they had interest, we wondered if they were far enough along technologically with regard to their acceptance of the cloud. Fortunately, a Tier One bank was willing to take a look at our technology. We went through many, many presentations within the bank, and ultimately that led to a consortium to fund the product.

FR: Given the regulatory climate, how do you go about passing muster from a compliance perspective?

JS: Since we were built on the Amazon Cloud, there is already a baseline of security built in. We built our own redundancy, encryption and recording capabilities on top of that to meet the requirements of Energy and Commodity traders. As we work with Tier One banks, we have continued to build security, compliance and resilience into the system to support their needs.

FR: What are the cost savings associated with going to a cloud-based solution?

JS: We operate with a SaaS-based model instead of one where a customer is charged not only per turret, but also for every telephone line established or moved. Savings are about 50 percent or more. But when you look at the savings, you see not only the savings on that particular instrument, but also in areas like disaster recovery.

FR: How important is disaster recovery to Cloud9’s value proposition?

JS: It’s very important. Historically, the way firms have dealt with disaster recovery is that they’ve actually had separate physical sites with $10,000 instruments — and all the different things that are required to make a trade — in a different location. That’s not only very expensive, but it’s also risky because you have to hope that your disaster recovery site is far enough away so as to avoid being hit by the same disaster. Because we are a cloud-based system, we can ensure that our clients can trade from pretty much anywhere.

FR: In terms of your current customers, what’s the mix like today?

JS: Right now our customer mix is very Energy focused, but once we start rolling out larger banks, I expect it to be in all asset classes.

FR: Speaking of big banks, I saw an entry on your blog discussing that some financial services firms are reluctant to take operations into the cloud. Given the number of high-profile hacks that we’ve been seeing, do you think caution is justified?

JS: That’s a good question. 60 percent of our engineering time is spent in the area of security and compliance. From the moment a person initiates a call on Cloud9 to the moment it’s over, we encrypt all of the data. For any Tier One bank, that’s the number one issue. I can say that most of those financial institutions — I can’t say all of them — but most of them have accepted the cloud in some form.

FR: You don’t have to sell the benefits of going to the cloud anymore?

JS: That’s correct. But when you’re bringing out a new technology, there are early adopters and then there are the mainstream entities. Right now, there are some Tier One banks that are early adopters of cloud technology; however, there are still a few that are not. You look at several large banks, even ones like Bank of America, and there’s still some caution about moving aggressively to the cloud.

FR: Let’s discuss one of your products. A Cloud9 client has said, “As much as we appreciate Gateway, we can’t wait for the day when we don’t use it.” What did he mean?

JS: Today, probably 80 percent of Energy traders have Cloud9. But 20 percent are still on traditional turrets. Our Gateway product is a segue that brings a line from a traditional system into our system so the two parties can connect, even if both are not on Cloud9.

FR: That means that if everyone in Energy is using Cloud9, then the Gateway solution no longer exists?

JS: Yes, because everyone will be able to connect through Cloud9 and won’t need to worry about interoperability between the old and new technology.

FR: Congratulations on your recent financing. Did you talk to traditional VCs or was a strategic consortium always in the plans?

JS: Thank you. VCs were never a consideration. The reason why we wanted financial institutions was because we wanted their business. They invest and then they also become clients.

FR: One of those backers, Pete Casella of Point72 Ventures, said, “Right now, the purchase of and support of the turret system is about a $1 billion per year industry.” Let’s say you build sizable share of that market. Where would Cloud9 go if you managed to replace most of the turrets out there?

JS: There are several things. Today, there are approximately 220,000 trading positions globally. We want to get our share of that market. On top of that, we’re coming out with a new product called Wavelength, which is an off-the-trading-floor product. The idea here is that, very often, there’s a need for people off the trading floor, such as analysts, researchers, and compliance managers, to speak to people on the trading floor.

FR: Will this be a mobile solution?

JS: It could be mobile or it could be a back office solution. And it basically more than doubles our market. Then you talk about things we could do outside of the trading floor environment. There are some organizations that need highly secure communications that we are in a good position to deliver on.

FR: So a fintech company going outside financial services. Is that what you are saying?

JS: Yes.

FR: When would you anticipate offering these services?

JS: We are evaluating our roadmap as we believe that there is an unmet need for our technology in other industries. And quite candidly, the reason why we started with the financial community is because most of the people in this organization started and grew their careers in the industry.

FR: So let’s return to your consortium of backers for a moment. Now that it’s a reality, is the access and perspective you get a dream scenario for a company like yours?

JS: (Laughs) It’s been a positive experience for us, but managing investors who are also customers can be challenging.

FR: Were you concerned that some of your investors’ competitors would ultimately not want to choose Cloud9?

JS: I don’t think so. Banks do consortiums all the time, and the whole point of the consortium is to build a community. And the people who aren’t in the consortium are still interested in our solutions because Cloud9 can save them money and resolve their disaster recovery problems. In the end, we’re not trying to be competitors with anybody.

FR: But you do have competitors. A company like Green Key for example?

JS: Absolutely, but it drives us to continuously innovate.

FR: So when you are pitching a new opportunity and you lose, why do you lose? Is it an allegiance to an antiquated system or one of the other disruptors out there?

JS: It can be a number of things. Sometimes a bank just wants to wait on the sidelines to see how our technology shakes out, and some institutions aren’t ready to implement cloud-based solutions.

FR: As younger professionals take on positions of responsibility, will that help you?

JS: Yes, very much so. Some people like a physical instrument in front them. It’s a security blanket. I don’t mean it in a bad way — it’s just that it makes them comfortable in their trading. I think the younger generation embraces cloud-based technologies a lot easier than older guys like me.

FR: Fair enough, but doesn’t it come down to who you are selling to within an institution?

JS: It’s interesting. In my market, I used to sell to the voice people. Today, it’s the traders and the business people who want the applications versus the trader voice people. But you still have to go through the trader voice people.

FR: With respect to hiring salespeople, are you looking for different kinds of people today than you would have five years ago?

JS: Yes. Some of our salespeople are former traders and it’s important that they have the ability to think outside of the box. We are changing the landscape of enterprise communications in financial services, and our sales personnel have to be capable of communicating that to our customers.

FR: One last question. I noticed a senior member of your team shared the same family name as you. How does being the CEO and dad work around the Thanksgiving table?

JS: The first thing you do is you make sure that the person doesn’t report to you. And the fact is, Cloud9 is not my company. I own a piece of the company, but there are many other shareholders and she (Dana Starr, Vice President of Professional Services) has to be judged on her merits. As a dad there’s a lot of pressure, but thankfully, she’s doing a great job so far.

FR: Thank you very much, Jerry. I wish you and your team great luck.

JS: Appreciate it. Thank you.

Read the Original Article on Financial Revolutionist.

Learn more about our recent funding round here.

by c9tec | Oct 20, 2016 | Press Coverage

Original Article on AlleyWatch

The advent of the internet has undoubtedly changed the speed of communication. Letters, faxes, and, memos are now all but obsolete. Cloud9 is tackling communications within financial services by harnessing the cloud. Using the platform, financial firms can now connect with institutional traders seamlessly and in a safe, secure manner.

AlleyWatch spoke with the company’s president, Greg Kenepp, about the newest features and the company’s latest round of funding from some powerhouses in the financial space.

Who were your investors and how much did you raise?

We received $30M in Series A funding led by JP Morgan, with Barclays, ICAP, and Point 72 Ventures. The round also includes individual participation by the principals of several leading firms who were among some of our earliest customers.

Tell us about your product or service.

Cloud9 is a cloud communications service provider that delivers high-performance voice and collaboration services for financial firms and institutional traders. We connect counterparties across all asset classes with an easy-to-use platform that eliminates costly infrastructure, features end-to-end security and encryption, and is fully compliant with the latest call recording and retention mandates.

We provide unprecedented levels of connectivity, with the Cloud9 Community feature enabling firms to make instant connections with fellow users and expand their business by discovering new counterparties in the directory.

We also have an open API strategy that enables our customers to connect Cloud9 with other services, as well as enabling other vendors to build new products on top of the Cloud9 platform.

What inspired the start of the company?

The cofounders of the company, including CEO, Jerry Starr; Chief Product Officer, Steve Kammerer; and CTO, Leo Papadopoulos, saw a clear need for a better communication solution in the trader voice space. Turrets, the legacy trader voice system, are a 40+ year old technology that lack a great deal of the functionality needed for a modern working environment. We wanted to eliminate the cost and complexity of dealing with traditional telephony solutions and bring the ease of communicating and connecting via consumer-based apps to the enterprise, so trading teams can talk to counterparties instantly – anywhere, and anytime.

With their knowledge of the industry, cloud services, and technology like WebRTC, they knew they could create a revolutionary platform that was inherently more reliable, less expensive, and of an enterprise-level quality.

How is it different?

Cloud9 is a truly disruptive technology – replacing legacy trader voice systems (turrets) that have become the status quo on trading floors. We have an advantage because we understand what traders need – especially when it comes to the level of quality firms expect, the level of security necessary to operate in the industry, and the level of compliance needed for the strict regulations in the industry.

Cloud9’s offering is up to 50% more affordable and can be used anywhere there is an internet connection. We also take into account features such as audio distribution, acoustical processing, and trade reconstruction compliance, as well as capabilities for partnership and integration with solutions that support trade-related activity.

What market you are targeting and how big is it?

We’re currently targeting the financial services industry, and even more specifically, institutional traders. There are 220,000 institutional traders and 2,500 trading floors globally.

What’s your business model?

We have a monthly, subscription-based model. Since our service doesn’t require hardware, it can be easily and inexpensively deployed across a business and managed by existing IT teams. There is no additional cost for scaling up or down based on business needs.

You had previously raised a round in April and now a round this month. Is there something that we should know?

After initially announcing our round in April, JP Morgan decided to commit additional capital to Cloud9. We also received a number of investment requests from some of the earliest adopters of our platform. We also welcomed Point 72 Ventures, whose participation comes as part of their strategy to invest in firms that will give them an edge and generate returns. This funding signals the close of our series A.

What was the funding process like?

For the second half of this round we were lucky to have some of our most loyal customers interested in investing in our service. We’re incredibly proud of this because these customers have tried our platform and experienced the benefits firsthand on their traders’ workflow and their balance sheets.

We’re also happy to have recognition from some of the largest influencers in the financial services industry, with increased investment from J.P. Morgan, who will be implementing our solution on their desks globally, and participation from Barclays and from ICAP, who is already using our service within its energy trading teams.

Point 72 Ventures believes that we’re transforming the way the buy-side and sell-side communicate across the capital markets and are interested in helping peers and trading counterparts in the industry convert to our platform.

Overall the funding process was a very positive experience, because we have supportive investors that trust the value of our product, our leadership, and our team.

What are the biggest challenges that you faced while raising capital?

Patience, once again, is the biggest challenge – even though we went through part of the process back in April and we had people approaching us and excited to be a part of this round, it doesn’t get easier. With financial institutions it takes time to work through the procedure and the details before everything becomes official.

What factors about your business led your investors to write the check?

Our investors have a great deal of confidence in our technology, largely due to the overwhelmingly positive response from traders. The product is easy to use, and requires little to no training to start connecting with counterparties. Traders often comment on the excellent voice quality as well as the reliability of the service, which can be used anywhere there is an internet connection. The Cloud9 Community also organizes trading partners by communities and asset classes, which makes it easy for traders to find existing counterparties or discover new business.

What are the milestones you plan to achieve in the next six months?

We just opened up our sales and support office in Singapore, and we plan to continue global expansion to serve demand for our service in other markets.

We also are focusing on expanding our communication services beyond the trading floor, serving the communication and collaboration needs of middle and back office support teams.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

The most important thing any company can do is focus on building their business – have a solid business plan in place, and the rest will come. Make sure you have a solid product that both your customers and potential investors will trust. The worst thing you can do is to constantly react to your competitors or chase an exit.

Where do you see the company going now over the near term?

Over the near time we are continuing to expand our company internally to accelerate the development of several products in great demand by our current customer base, such as our interoperability services.

Where is your favorite fall destination in the city?

While Central Park is a great place to catch some fall foliage, I recommend Fort Tryon Park in upper Manhattan. It’s a beautiful park with majestic views of the Hudson!

Original Article on AlleyWatch